This capital injection of €14.3 million by Advanced BioDesign’s sole shareholder comes at the right time, given that the biotech company has initiated a crucial phase in the development of its treatment targeting acute myeloid leukemia (AML), one of the most common and severe leukemias in adults over the age of 60 with a 5-year survival rate not exceeding 20%. “This investment comes at a key time when our financial requirements are greater as a result of the launch of our large-scale clinical trial,” said Ismail Ceylan, CEO of Advanced BioDesign. The first patient recruitments for the ODYSSEY clinical trial started two months ago, at the Assistance Publique – Marseille Hospitals, the Civil Hospices in Lyon and the Saint-Louis Hospital in Paris.

This substantial capital increase, which will be paid in successive installments, will enable ABD to continue a multicenter clinical trial, which aims to evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics of its drug candidate ABD-3001 via monotherapy in patients who are refractory to or have relapsed on standard therapies and for whom therapeutic options are limited and prognosis is poor. At the same time, these funds will help prepare the Phase II clinical trial for ABD-3001.

The ODYSSEY study is organized according to an adaptive design, integrating a first part with a single ascending dose, lasting 12 months on 6 cohorts of patients, followed by a second part of an equivalent duration, where 3 cohorts of patients will undergo a complete treatment cycle of four weeks. In total, between 30 and 70 patients will be recruited in Paris, Lyon and Marseille.

The administration of the first dose of drug candidate ABD-3001 has been successfully carried out. The second dose is expected to be administered shortly, after validation by a data and safety monitoring board.

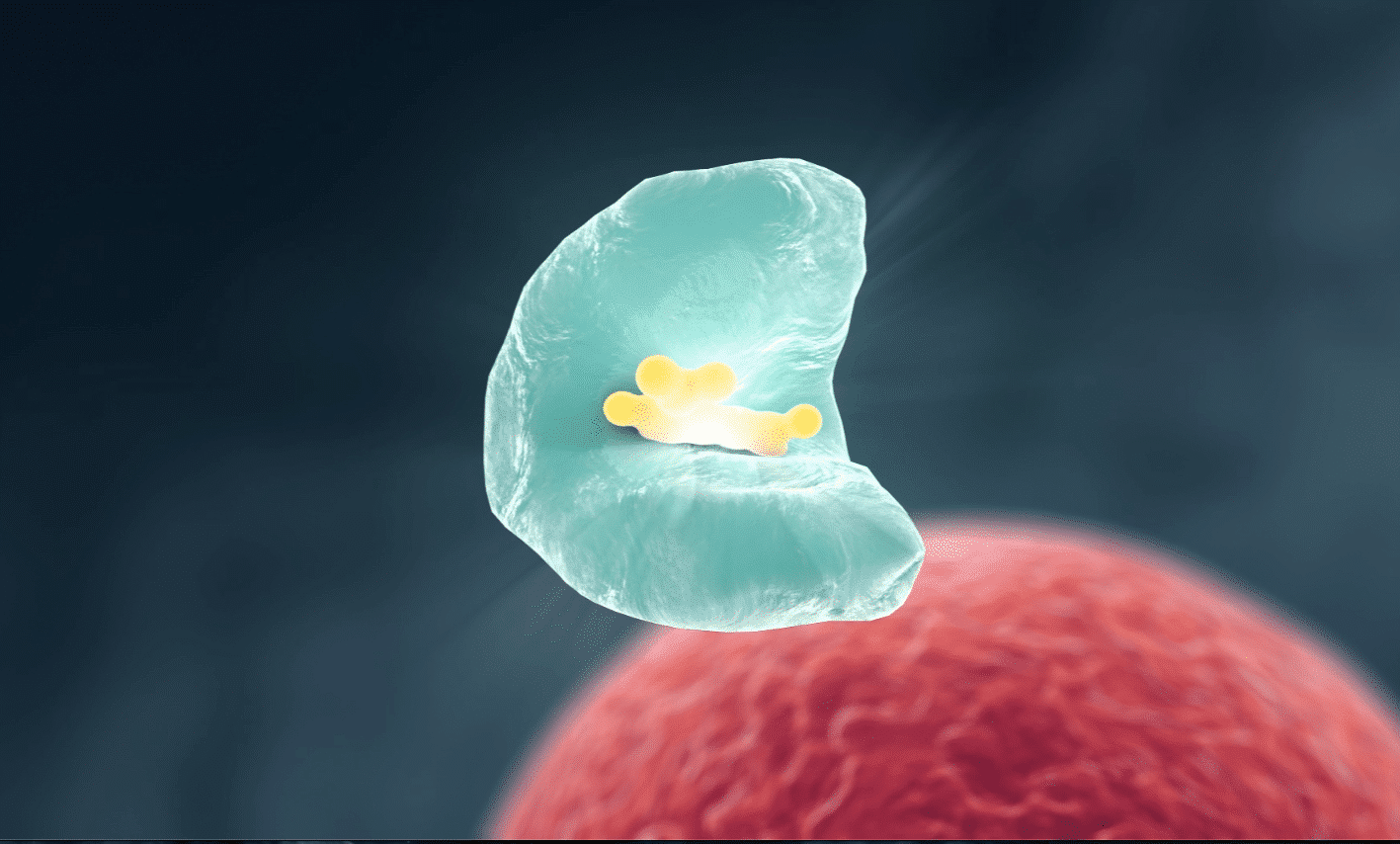

DIMATE (ABD-3001), is a first-in-class suicide inhibitor of aldehydes dehydrogenases 1&3 (ALDH1&3). It targets and inhibits ALDH1A1, the detoxification enzyme present in leukemia cell of patients suffering from AML. This enzyme allows them to survive the inevitable metabolic disturbances that occur during the cancer process and that often lead to the production of highly toxic molecules for the cells. By stopping the detoxification process, DIMATE poisons and kills cancer cells, without harming healthy cells.

DIMATE also destroys cancer stem cells, that are highly resistant to the cytotoxic effects of current anti-cancer drugs. This resistance to treatment appears to be the main cause for regular cancer relapses.

“The start of our first-in-human ODYSSEY study and our very ambitious roadmap for the next few years are good reasons to be delighted with this capital injection from Xerys Invest. (…) By late 2024/early 2025, we will be in possession of sufficient information on the effect of DIMATE, to determine the maximum tolerated dose, the biological activity biomarkers, the frequency of weekly administration and the length of the cycle, to start a phase II in which we will this time observe the efficacy of the treatment,” Ismail Ceylan, CEO of Advanced BioDesign.

If it is validated, ABD-3001 will be indicated for patients who are refractory to or have relapsed on standard therapies after treatment, in combination with a chemotherapy or radiotherapy protocol. These associations could lead to a significant synergy for the treatment of resistant cancers.

In time, the biotech company intends to expand its research to other forms of resistant cancer, based on the most significant unmet needs.

Xerys Invest has been supporting Advanced BioDesign since 2013. This amount of €14.3 million is in addition to the €22 million already raised by the investment company. A new fundraising will be necessary by the end of the year/early 2024, when other investors may take a stake in its capital, in particular pharmaceutical company funds.